Titan is part of the Augusta Group which has an established track record of value creation

Titan owns the Empire State Mines (“ESM”) including the Kilbourne Graphite Project based in New York State.

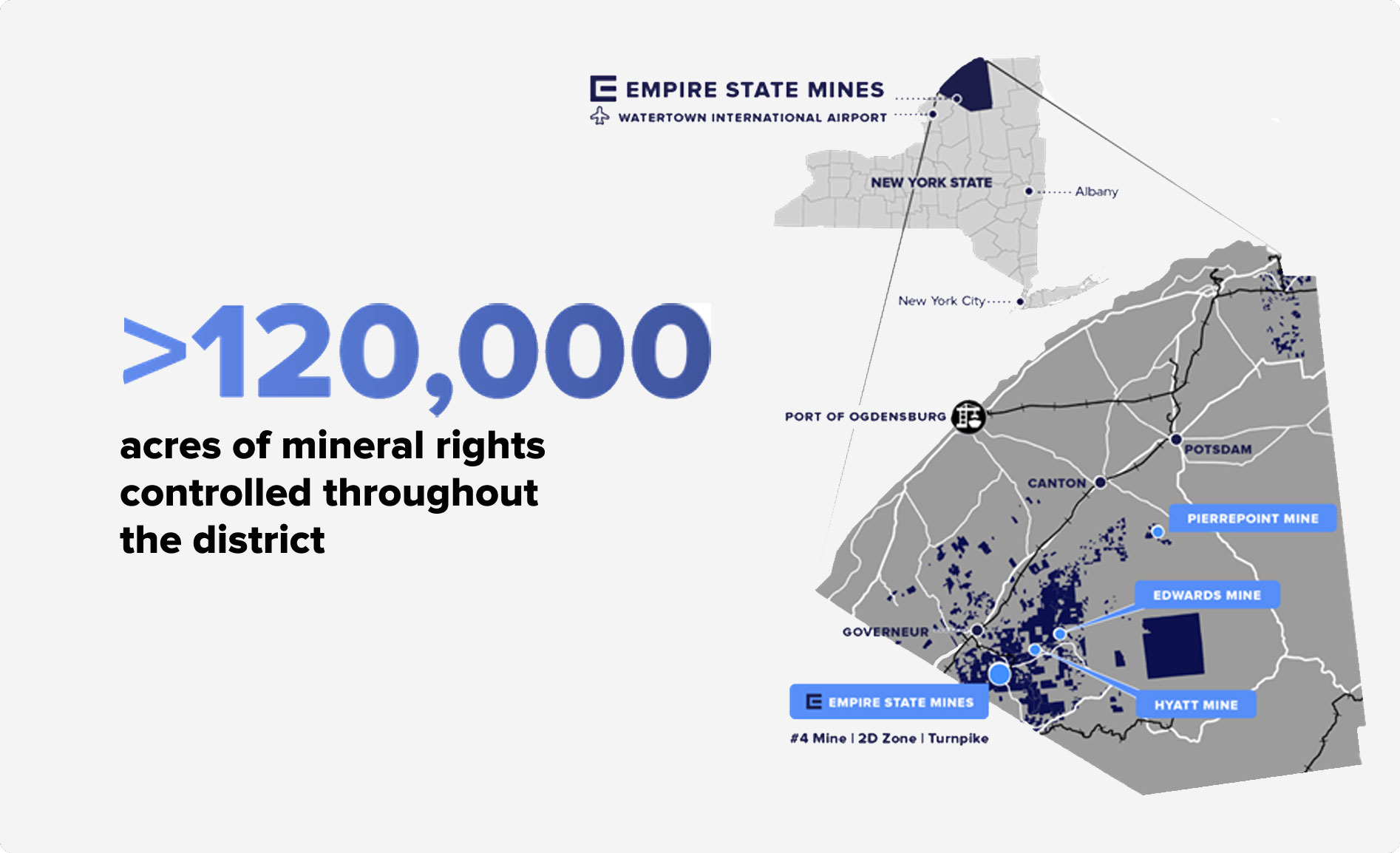

Our Zinc operations at ESM comprise a group of high-grade operational mines in St. Lawrence County, New York State - ESM #4 mine which is in production, and six historic mines which have the ability to further feed our 5,000 tpd onsite mill. ESM #4 mine restarted mining production in 2018 with current annual production of approximately 60mlbs of zinc concentrate. ESM controls over 120,000 acres of mineral rights in the region with significant exploration potential.

Located less than 4,000ft from the existing mill site, is the Kilbourne Graphite Project. Titan declared a maiden open-pit constrained inferred mineral resource estimate of 22 million US short tons at an average grade of 2.91% (Cg) containing 653,000 tons of graphite in December 2024. Nearly all of the deposit sits within ESM’s active use permit. We are uniquely positioned to leverage the existing mill and infrastructure at ESM to fast track commercial production of graphite and target being first to market as a US domestic supplier of graphite concentrate.

Investment Highlights

- U.S production base in upstate New York

- Existing infrastructure includes 5,000 tpd mill, skilled workforce of 135 employees, rail, port, and air access

- Cash flow positive zinc mine

- Existing permitted operations with state level permitting only

- 120,000 acres of mineral rights controlled throughout the district

- Regional district scale and near mine exploration potential and ability to add incremental production at low cost

- Significant graphite discovery at Empire State Mine’s (ESM)’s property

- The Kilbourne Graphite Project is a near surface discovery within 1 mile of the ESM mill

- Unique advantage of existing operating base creating pathway for co-production

- 1,200 tpa fully permitted graphite processing facility commissioning in H2 2025

- First end-to-end natural flake graphite production in the USA since 1956

- Target to be the first commercial producer of US-sourced and processed graphite

Our Mission

Titan’s goal is to deliver shareholder value through operational excellence, development and exploration. We have a strong commitment towards developing critical minerals assets which enhance the security of the domestic supply chain.